Using AI to deliver better customer experience in Michigan

Key takeaways

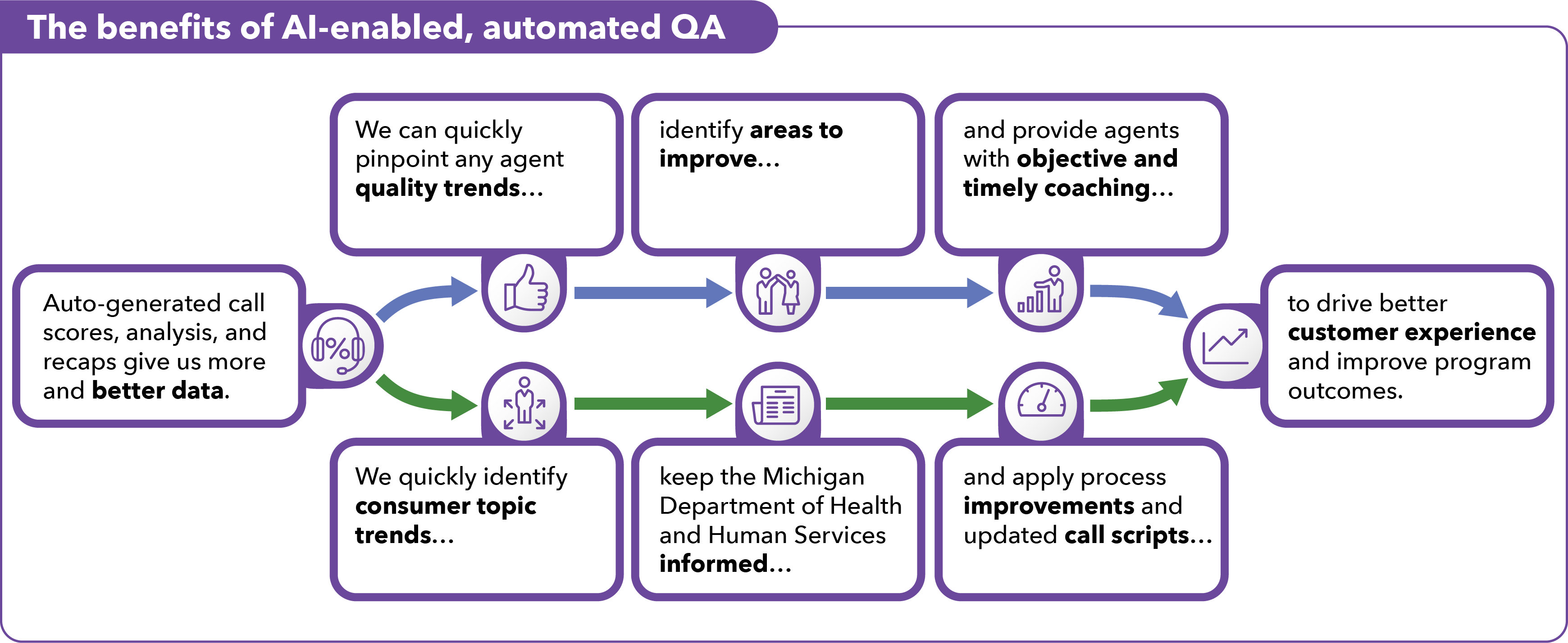

We’re using artificial intelligence to improve the quality assurance process at a large customer contact center serving public health insurance programs in Michigan.

A new approach to quality assurance.

You can only improve what you can measure. And assessing something as nuanced as the quality of interactions between a program participant and a customer contact center agent is difficult. Cutting-edge technology like artificial intelligence (AI) can help.

Selecting the right health insurance plan can be a complex task. Since 1997, we've been empowering Michiganders participating in the state’s Medicaid program with a person-centric and simplified enrollment process. We provide them with unbiased, culturally competent choice counseling services so they can select the health coverage that’s best for them and their families. Because our work supports the wellbeing of so many people, quality is key — both in the program and plan information we share and the customer service we provide.

Challenge

Recording caller interactions with agents is a common practice for ensuring continuous quality in contact center operations. For our Michigan Enrollment Broker operations, quality assurance (QA) historically meant QA specialists reviewed a sample of call recordings across the program, then call center leads completed manual evaluations of a subset of calls for each customer service agent. As the volume and complexity of calls grew, we wanted to enhance the QA process to share call trends with our client and provide more actionable feedback to our agents who serve a critical role in helping callers understand their plan choices.

Solution

To streamline the QA process, we implemented a conversation intelligence platform that uses AI technology to analyze agent-caller interactions. The AI-enabled platform processes call content and provides immediate insights through our configurated communication analysis. The platform also quickly generates call recordings and auto-transcribes them for further analysis.

Using AI, we developed an agent performance scorecard to objectively score at least 90% of all calls. Our QA specialists now use the scorecard results to identify specific calls that may require further review and agent coaching. By evaluating trends in performance data, our QA specialists can provide recommendations for training improvements.

Results

- Introducing QA automation allowed us to move from manually evaluating a sample of calls to evaluating at least 90% of calls.

- Giving supervisors real-time visibility enabled them to provide targeted feedback to agents and adjust call scripts as needed. This continuous feedback loop resulted in a 12.5% increase in average quality scores of up to 90 (out of 100) in just 3 months.

- Following the implementation of the AI-enabled platform, 93% of callers affirmed we answered their questions (a 2.5% increase) and 93% of callers rated our overall service as “excellent” (a nearly 2% increase).

The Maximus difference

By combining the power of AI with agents who take pride in delivering exceptional service, we have an even more efficient quality assurance process and enhanced customer experience for people enrolling in health insurance coverage. Our approach created a positive total experience for program agents and callers — one conversation at a time.